| > | In addition to the requirements of Section 304 of the Sarbanes-Oxley Act of 2002 that are applicable to our Chief Executive Officer and Chief Financial Officer; and |

| > | Otherwise deemed automatically amended to include the requirements of Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, as it may be amended from time to time, and any related rules or regulations promulgated by the SEC or the NYSE. |

Wall Street Reform and Consumer Protection Act, as it may be amended from time to time, and any related rules or regulations promulgated by the SEC or the NYSE.

Our Compensation Committee intends tomay periodically review this clawback policy and, as appropriate, conform it to any applicable final rules adopted pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act.

policy.

Hedging and Pledging of

ourOur Securities

Our

directors and employees, including our Named Executive Officers, are prohibited from engaging in a transaction meant to hedge or minimize losses in our securities, including engaging in transactions in

forward contracts, equity swaps, collars, exchange funds, puts, calls,

oroptions and other derivatives on our securities, or

short-sellingshort selling our securities.

Our

directors and employees, including our Named Executive Officers, are prohibited from pledging our securities as collateral for a loan unless such pledging

transaction is approved by our General Counsel.

Minimum Equity Ownership Guidelines for

Named Executive Officers

In February 2018, our

Our Compensation Committee

adoptedhas implemented minimum equity ownership guidelines that require each Named Executive Officer to maintain equity ownership in the company (including Partnership Units, LTIP Units or

restricted stock units)RSUs) having a market value equal to or greater than a multiple of such Named Executive Officer’s base salary (ten times base salary for the Chairman and

Chief Executive OfficerCEO and five times

base salary for

the other

Named Executive Officers). Each

executive officerNamed Executive Officer must achieve the minimum equity investment within five years from the later of the adoption of the guidelines (for Named Executive Officers in place at that time of the adoption of the guidelines) and the date of such Named Executive Officer’s appointment (for subsequently appointed Named Executive Officers).

All Named Executive Officers are, or are expected to be within the time ascribed in our ownership guidelines, in compliance with our Minimum Equity Ownership Guidelines. | Named Executive Officer | | | Ownership

Requirement Multiple | | | Ownership

Requirement Value |

Named Executive Officer/Director

| | Ownership

Requirement Multiple

| | Ownership

Requirement Value

|

Paul J. Taubman | | 10X | 10x Base Salary | | | $10,000,000 |

Ji-Yeun Lee | | 5X | 5x Base Salary | | | $5,000,000 |

Helen T. Meates | | 5X | 5x Base Salary | | | $2,500,0005,000,000 |

James W. Cuminale

David A. Travin | | 5X | 5x Base Salary | | | $2,500,000 |

Our Compensation Committee also adopted minimum equity ownership guidelines for ournon-management directors. See “Compensation of Directors—Minimum Equity Ownership Guidelines” above.

Our practice is to grant equity awards to our Named Executive Officers that generally vest over a period of several years, with the vesting of the first tranche of any such equity award at least one year from the grant date. For performance year 2023, equity awards granted to our Named Executive Officers and other partners vest over a four-year period, with equity awards vesting in equal installments following the second, third and fourth year anniversaries from grant.

TABLE OF CONTENTS

No Individual Revenue

Pay-OutsWe have

a no individual revenue

pay-outs philosophy as it relates to annual incentive compensation, and no contractual entitlement to severance. To provide further flexibility with respect to employment and compensation matters, we maintain a flexible termination practice with no contractual rights to continued employment (other than for a notice and

potential garden leave period)

and no contractual right to severance upon termination..

Risk Considerations in

ourOur Compensation Programs

Our Compensation Committee has discussed the concept of risk as it relates to our compensation programs with management and Willis Towers Watson, and our Compensation

Committee does not believe the goals, or the underlying philosophy of our compensation programs encourage excessive or inappropriate risk taking.

Our discretionary compensation program is designed to reflect the performance of our

firmcompany and the performance of the individual employee, and we believe its design discourages excessive risk taking. For example, paying a significant portion of discretionary compensation in the form of equity awards, all with multi-year vesting periods, encourages each of our senior professionals to be sensitive to long-term risk outcomes, as the value of their awards increase or decrease with the price of our Class A common stock. Our

directors, Named Executive Officers,

partners and employees are prohibited from hedging their shares of our Class A common stock and from pledging such shares without

pre-approval of our General Counsel. We believe these criteria

will provide

our employees additional incentives

to prudently managefor the prudent management of the range of risks inherent in our business. Based on this, we do not believe that our compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the company.

Award Timing

Annual equity awards were granted to Named

40

Executive Officers and all other PJT Partners employees on February 13, 2018 following the company’s public announcement of its financial results for the prior fiscal year. The equity awards were delivered in the form of restricted stock units with aggregate number of restricted stock units determined on the basis of the average closing price of a share of Class A common stock over the five trading days immediately prior to and the five trading days immediately following the date that PJT Partners first publicly issued its earnings release for full year 2017, with grants made effective the final day of this window.Compensation

TABLE OF CONTENTS

REPORT OF THE COMPENSATION COMMITTEE

The following Compensation Committee report to

stockholdersshareholders shall not, in accordance with the rules of the SEC, be incorporated by reference into any of our future filings made under the Exchange Act or under the Securities Act and shall not be deemed to be soliciting material or to be filed under the Exchange Act or the Securities Act.

Our Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation

S-K with management and, based on such review and discussions, our Compensation Committee recommended to

ourthe Board

of Directors that our Compensation Discussion and Analysis be included in this Proxy Statement.

Submitted by

ourthe Compensation Committee:

Thomas M. Ryan, Chair

Emily K. Rafferty

TABLE OF CONTENTS

Dennis S. Hersch

Summary Compensation Table

The following table summarizes the total compensation paid to or earned

by each of our Named Executive Officers in respect of fiscal years

2015, 20162021, 2022 and

2017,2023 for Mr. Taubman, Ms. Lee, Ms. Meates and Mr. Travin, each under the rules of the SEC.

| | | | | | | | | | |

Name and Principal Position | | Year | | Salary

$ | | Bonus(1)

$ | | Stock

Awards(2)

$ | | Total

$ |

Paul J. Taubman | | 2017 | | 1,000,000 | | — | | — | | 1,000,000 |

Chairman and CEO | | 2016 | | 1,000,000 | | — | | — | | 1,000,000 |

| | 2015 | | 250,000 | | — | | 75,202,100 | | 75,452,100 |

| | | | | |

Ji-Yeun Lee | | 2017 | | 1,000,000 | | 1,562,500 | | 649,800 | | 3,212,300 |

Managing Partner | | 2016 | | 1,000,000 | | 2,850,200 | | — | | 3,850,200 |

| | 2015 | | 87,500 | | 650,000 | | 12,272,950 | | 13,010,450 |

| | | | | |

Helen T. Meates | | 2017 | | 500,000 | | 1,037,500 | | 305,462 | | 1,842,962 |

Chief Financial Officer | | 2016 | | 500,000 | | 1,694,538 | | — | | 2,194,538 |

| | 2015 | | 125,000 | | 1,750,000 | | 2,386,100 | | 4,261,100 |

| | | | | |

James W. Cuminale | | 2017 | | 500,000 | | 900,000 | | 285,468 | | 1,685,468 |

General Counsel | | 2016 | | 350,000 | | 1,614,532 | | — | | 1,964,532 |

| | 2015 | | 87,500 | | 1,562,500 | | 2,529,150 | | 4,179,150 |

Name and

Principal | | | Year | | | Salary | | | Bonus(1) | | | Stock

Awards(2)(3) | | | Other(3) | | | Total |

Paul J. Taubman

Chairman and CEO | | | 2023 | | | $1,000,000 | | | — | | | — | | | $29,620 | | | $1,029,620 |

| | 2022 | | | $1,000,000 | | | — | | | $39,100,000 | | | $16,595 | | | $40,116,595 |

| | 2021 | | | $1,000,000 | | | — | | | — | | | $15,000 | | | $1,015,000 |

Ji-Yeun Lee

Managing Partner | | | 2023 | | | $1,000,000 | | | $1,847,700 | | | $1,653,164 | | | $29,620 | | | $4,530,484 |

| | 2022 | | | $1,000,000 | | | $1,852,500 | | | $1,971,031 | | | $16,595 | | | $4,840,126 |

| | 2021 | | | $1,000,000 | | | $1,867,500 | | | $1,649,703 | | | $15,000 | | | $4,532,203 |

Helen T. Meates

Chief Financial Officer | | | 2023 | | | $1,000,000 | | | $1,422,500 | | | $1,352,121 | | | $29,620 | | | $3,804,241 |

| | 2022 | | | $500,000 | | | $1,652,500 | | | $1,608,809 | | | $16,595 | | | $3,777,904 |

| | 2021 | | | $500,000 | | | $4,667,500 | | | $1,346,550 | | | $15,000 | | | $6,529,050 |

David A. Travin

General Counsel | | | 2023 | | | $500,000 | | | $1,071,500 | | | $624,613 | | | $29,620 | | | $2,225,733 |

| | 2022 | | | $500,000 | | | $1,027,500 | | | $633,889 | | | $16,570 | | | $2,177,959 |

| | 2021 | | | $500,000 | | | $725,000 | | | $138,720 | | | $15,000 | | | $1,378,720 |

(1)

| (1) | 2017

2023 bonus amounts represent the cash component of the annual incentive compensation earned for 20172023 performance and paid in the following year. TheIn the case of Ms. Lee, Ms. Meates and Mr. Travin, the remainder of the 20172023 performance year annual incentive compensation was paid in the form of restricted stock units,RSUs, as discussed above in “Executive“Elements of Our Compensation Elements—Program—Annual Incentive Compensation—Long-Term Incentive Awards.Awards.” As these restricted stock unitsRSUs were granted on February 13, 2018,in 2024, pursuant to the rules of the SEC, the bonus amountsstock awards reported for 20172023 for Ms. Lee, Ms. Meates and Mr. CuminaleTravin do not include their respective portion of the annual incentive compensation that was paid in restricted stock units.RSUs. The amounts grantedpaid in the form of restricted stock unitsRSUs for performance year 2017 were2023 are as follows: Ms. Lee—$1,937,500,1,640,300; Ms. Meates—$962,500,1,065,900; and Mr. Cuminale—Travin—$850,000.666,500. |

(2)

| (2) | The amounts included in this column represent the aggregate grant date fair value of the equity awards computed in accordance with ASC Topic 718. A discussion of the assumptions used in calculating these |

| values can be found in Note 10 to our 20172023 audited financial statements included in our Annual Report on Form10-K for the year ended December 31, 2017.2023. For 2017,2022, the value represents Performance LTIPs granted on February 10, 2022 to Mr. Taubman, Ms. Lee, Ms. Meates and Mr. Travin. Consistent with granting these long-term Performance LTPIs the company does not currently anticipate paying Mr. Taubman any further equity incentive compensation through the end of 2026. In the case of Mr. Lee, Ms. Meates and Mr. Travin these awards appertain to the 2021 performance year. Performance LTIPs are subject to both service and performance conditions. Performance LTIPs satisfy the time-vesting requirement over a five-year period, with 20% of the service condition met per year commencing on March 1, 2023. The performance condition for the Performance LTIPs will be deemed satisfied to the extent that the company’s Class A common stock achieves the designated dividend-adjusted per-share prices ranging from $100 to $130. The number of Performance LTIPs for which the performance condition has been met will be determined (i) on a quarterly basis at the end of each fiscal quarter to occur after the grant date and (ii) as of restricted stock unitsand for the period ended on February 15, 201728, 2027 (the “End Date”), based on the highest 20-day VWAP to have been achieved at any time starting on the grant date and ending on the applicable quarter-end measurement date, throuh the End Date. If, as of any measurement date, the highest 20-day VWAP is between $100 and $130, then the percentage of the total Performance LTIPs that will become Earned Performance LTIPs as of such time shall be determined by linear interpolation between 50% and 100%. The number of Performance LTIPs reported reflects the total number of units granted even though the performance period will not end until February 28, 2027 and vesting is contingent on meeting volume-weighted average share price targets. Therefore, there is no assurance that any portion of these units will be earned. Given that the Performance LTIPs vest according to service and market conditions, they have no maximum grant date fair values that differ from the grant date fair values presented in the table. |

(3)

| We make available to our partners, including our Named Executive Officers, financial planning services on an annual basis paid for by the 2016 performance year.company. In 2023, each of our Named Executive Officers used this service. The amount includes charitable contributions made by the company to charitable organizations selected by Named Executive Officers pursuant to the Partners Giving Program described above in the section titled, “Employee Benefits; Perquisites.” Named Executive Officers do not receive any direct financial benefit from the Partners Giving Program because the charitable deductions accrue solely to the company. In addition, we make available to our CEO and on occasion by exception, to other partners, including our Named Executive Officers, personal use of a company leased aircraft when it is not being used for business purposes, for which the company is reimbursed the full incremental costs associated with such use. |

TABLE OF CONTENTS

Grants of Plan-Based Awards in

20172023

The following table discloses the number of plan-based awards granted in

20172023 to our Named Executive Officers and the grant date fair value of these awards.

| | | | | | | | |

Name | | Grant Date | | Action Date(1) | | All Other Stock Awards:

Number of Shares of

Stock or Stock Units(2)

(#) | | Grant Date Fair

Value of Stock

and Option Awards(3)

($) |

Paul J. Taubman | | — | | — | | — | | — |

Ji-Yeun Lee | | 2/15/17 | | 1/12/17 | | 19,152 | | 702,112 |

Helen T. Meates | | 2/15/17 | | 1/12/17 | | 9,003 | | 330,050 |

James W. Cuminale | | 2/15/17 | | 1/12/17 | | 8,414 | | 308,457 |

Estimated Future Payouts Under Equity Incentive Plan Awards | Name | | | Grant

Date | | | Action

Date(1) | | | All Other stock

Awards: Shares of

Stock or Stock Units(2) | | | Grant Date

Fair Value

of Stock and

Option

Awards(3) |

| Paul J. Taubman | | | — | | | — | | | — | | | — |

| Ji-Yeun Lee | | | 5/24/23 | | | 5/24/23 | | | 21,208 | | | $1,653,164 |

| Helen T. Meates | | | 5/24/23 | | | 5/24/23 | | | 17,346 | | | $1,352,121 |

| David A. Travin | | | 5/24/23 | | | 5/24/23 | | | 8,013 | | | $624,613 |

(1)

| (1) | Restricted stock unitRSU awards awarded as long-term incentives are granted in the year following the fiscal year performance period. For instance, the restricted stock unitsRSUs granted to each of the Named Executive OfficersMs. Lee, Ms. Meates and Mr. Travin for 2017performance year 2023 were actually granted in February 20182024 and, therefore, are not included in this table since they were not granted in 2017.

2023. |

(2)

| | The Compensation Committee acted to awardyear-end equity based awards for the 2016 performance period at its regularly scheduled meeting on January 12, 2017, with the grants becoming effective on February 15, 2017.

|

| (2) | Represents restricted stock unitsRSUs granted in fiscal 2023 to each Named Executive Officer, other thanof Ms. Lee, Ms. Meates and Mr. Taubman,Travin, each for 20162022 performance. Any dividends paid by us on our Class A common stock will be accrued in additional restricted stock unitsRSUs on such restricted stock unitRSU amounts and such additional dividend restricted stock unitsRSUs so credited shall be or become vested to the same extent as the restricted stock unitsRSUs that resulted in the crediting of such additional restricted stock unitsRSUs with respect to each vesting tranche of restricted stock units. RSUs. |

(3)

| (3) | We used theThe average closing price of a share of our Class A common stock over the five trading days immediately prior to and the five trading days immediately following the date that we first publicly issued our earnings release for 2017fiscal year 2022 (with the date earnings are released representing the first day of the second five day period) was used in order to determine the number of restricted stock unitsRSUs to be granted, with grants made effective on February 15, 2017, the final day of this window period.May 24, 2023 following Compensation Committee approval on May 24, 2023. Since the grant date fair value of these restricted stock unitRSU awards is computed in accordance with GAAP,ASC Topic 718, the amounts reported generally differ from the dollar amount of the portion of the 20162022 performance year long-term incentive award grant.

|

Narrative Disclosure Relating toTABLE OF CONTENTS

Equity Awards at 2023 Fiscal Year-End The following table sets forth the Summaryoutstanding equity awards held by our Named Executive Officers as of December 31, 2023.

| | | Stock Awards |

| Name | | | Number of Shares

or Units of

Stock that Have

Not Vested | | | Market Value of

Shares or Units of

Stock that Have

Not Vested(1) | | | Equity

Incentive

Plan Awards:

Number of

Unearned

Shares, Units or

Other Rights that

Have Not

Vested(2) | | | Equity

Incentive

Plan Awards:

Market or

Payout Value of

Unearned

Shares, Units or

Other Rights that

Have Not Vested |

| Paul J. Taubman | | | 400,000(3) | | | $40,748,000 | | | 500,000 | | | $50,935,000 |

| Ji-Yeun Lee | | | 57,667(4) | | | $5,874,537 | | | 25,205 | | | $2,567,633 |

| Helen T. Meates | | | 47,009(5) | | | $4,788,764 | | | 20,573 | | | $2,095,772 |

| David A. Travin | | | 20,495(6) | | | $2,087,819 | | | 8,106 | | | $825,758 |

(1)

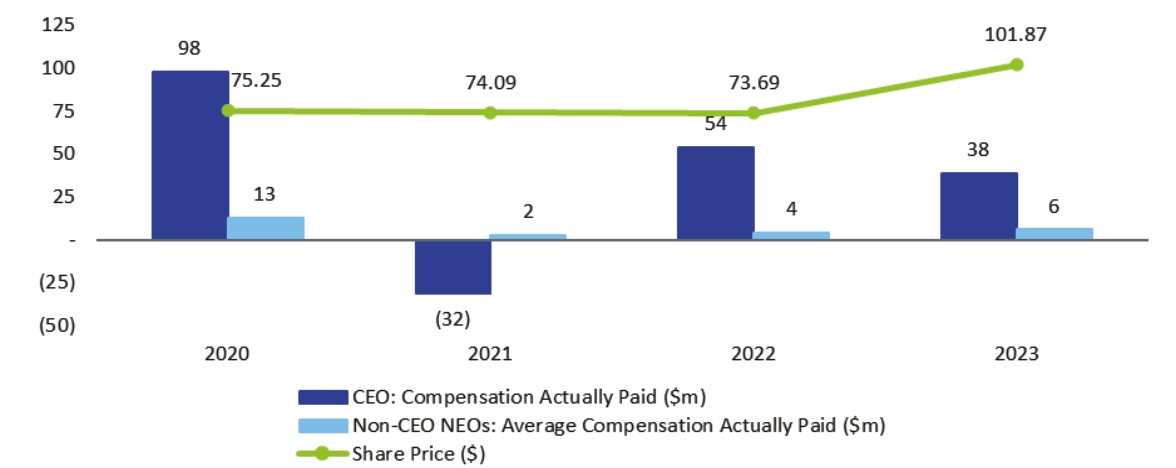

| Based on the closing price of our Class A common stock of $101.87 on December 31, 2023. |

(2)

| Amounts included in this column reflect Performance LTIPs granted on February 10, 2022. Performance LTIPs are subject to both service and performance conditions. Performance LTIPs satisfy the time-vesting requirement over a five-year period, with 20% of the service condition met per year commencing on March 1, 2023. The performance condition for the Performance LTIPs will be deemed satisfied to the extent that the company’s Class A common stock achieves the designated dividend-adjusted per-share prices ranging from $100 to $130. The number of Performance LTIPs for which the performance condition has been met will be determined (i) on a quarterly basis at the end of each fiscal quarter to occur after the grant date and (ii) as of and for the period ended on the End Date, based on the highest 20-day VWAP to have been achieved at any time starting on the grant date and ending on the applicable quarter-end measurement date, through the End Date. If, as of any measurement date, the highest 20-day VWAP is between $100 and $130, then the percentage of the total Performance LTIPs that will become Earned Performance LTIPs as of such time shall be determined by linear interpolation between 50% and 100%. The number of Performance LTIPs reported reflects the total number of units granted even though the performance period will not end until February 28, 2027 and vesting is contingent on meeting volume-weighted average share price targets. Therefore, there is no assurance that any portion of these units will be earned. During the year ended December 31, 2023, the Company achieved a 20-day VWAP in excess of $100. |

(3)

| This amount consists of (i) 100,000 LTIPs that vest on March 1, 2024, (ii) 100,000 LTIPs that vest on March 1, 2025, (iii) 100,000 LTIPs that vest on March 1, 2026 and (iv) 100,000 LTIPs that vest on March 1, 2027. |

(4)

| This amount consists of (i) 7,513 RSUs and 5,041 LTIPs that vest on March 1, 2024, (ii) 14,583 RSUs and 5,041 LTIPs that vest on March 1, 2025, (iii) 7,069 RSUs and 5,041 LTIPs that vest on March 1, 2026, (iv) 7,069 RSUs and 5,041 LTIPs that vest on March 1, 2027 and (v) 1,268 unvested dividend equivalent RSUs. |

(5)

| This amount consists of (i) 6,133 RSUs and 4,115 LTIPs that vest on March 1, 2024, (ii) 11,915 RSUs and 4,115 LTIPs that vest on March 1, 2025, (iii) 5,782 RSUs and 4,115 LTIPs that vest on March 1, 2026, (iv) 5,782 RSUs and 4,115 LTIPs that vest on March 1, 2027 and (v) 939 unvested dividend equivalent RSUs. |

(6)

| This amount consists of (i) 2,300 LTIPs that vest on March 1, 2024, (ii) 6,921 RSUs and 2,300 LTIPs that vest on March 1, 2025, (iii) 2,671 RSUs and 1,621 LTIPs that vest on March 1, 2026, (iv) 2,671 RSUs and 1,621 LTIPs that vest on March 1, 2027 and (v) 389 unvested dividend equivalent RSUs. |

44

Executive Compensation Table

TABLE OF CONTENTS

2023 Option Exercises and

the Grants of Plan-Based Awards TableStock Vested The following table sets forth certain information regarding equity awards that vested in 2023 for our Named Executive Officers.

| | | Stock or Unit Awards |

| Name | | | Number of Shares or Units Acquired

on Vesting(1)

(#) | | | Value Realized on Vesting(2) |

| Paul J. Taubman | | | 100,000 | | | $10,306,000 |

| Ji-Yeun Lee | | | 24,716 | | | $2,071,489 |

| Helen T. Meates | | | 18,031 | | | $1,521,733 |

| David A. Travin | | | 3,427 | | | $309,493 |

(1)

| Represents the aggregate number of RSUs, LTIPs and Performance LTIPs to Mr. Taubman, Ms. Lee, Ms. Meates and Mr. Travin, that vested in 2023. During the year ended December 31, 2023, a portion of Performance LTIP Units vested on the basis of achieving the first performance hurdle of a 20-day VWAP in excess of $100 and having satisfied the first service condition of the award. |

(2)

| The value realized on vesting of the equity awards is the product of (a) the closing price on the NYSE of a share of our Class A common stock on the vesting date (or, if the vesting date was not a trading day, the immediately preceding trading day), multiplied by (b) the number of equity awards vested. |

TABLE OF CONTENTS

Partner Agreement with Paul J. Taubman

PJT Partners Holdings entered into a partner agreement with Mr. Taubman (the “CEO Agreement”) oneffective October 1, 2015. The CEO Agreement provides for an annual base salary of $1,000,000 through October 1, 2018, the third anniversary of the closing of the merger andspin-off transactions. Thereafter, Mr. Taubman’s compensation will be determined by our Compensation Committee, subject to a minimum annual base salary of $350,000.

Mr. Taubman is generally subject to covenants ofnon-competition andnon-solicitation of employees, consultants, clients and investors during his service to PJT Partners Holdings and for a period (the “Restriction Period”) ending on the later of (x) March 31, 2017 and (y) one year following the termination of his service to PJT Partners Holdings in the case of thenon-competition restrictions, and two years following the termination of his service to PJT Partners Holdings in the case of thenon-solicitation restrictions. If Mr. Taubman is terminated by PJT Partners Holdings without cause or he resigns for good reason, the foregoing periods of time during which he will be subject to thenon-competition restrictions will be reduced to 120 days and 90 days, respectively. If Mr. Taubman’s service with PJT Partners Holdings is terminated for any reason other than his resignation without Board Change Good Reason or a termination of service by PJT Partners Holdings for cause, in each case within 24 months following a Board Change of Control, then (1) the covenants ofnon-competition andnon-solicitation of client and investors will expire upon termination, and (2) the covenants ofnon-solicitation of employees and consultants will expire six months after termination. Mr. Taubman is also subject to perpetual covenants of confidentiality andnon-disparagement.

(1)

| the covenants of non-competition and non-solicitation of clients and investors will expire upon termination, and |

(2)

| the covenants of non-solicitation of employees and consultants will expire six months after termination. Mr. Taubman is also subject to perpetual covenants of confidentiality and non-disparagement. |

For purposes of the CEO Agreement:

“cause” means the occurrence or existence of any of the following: (i) Mr. Taubman’s willful act of fraud, misappropriation, or embezzlement against PJT Partners Holdings that has a material adverse effect on the business of PJT Partners Holdings; (ii) Mr. Taubman’s conviction of a felony; or (iii) anun-appealable final determination by a court or regulatory body having authority with respect to securities laws that Mr. Taubman violated any applicable securities laws or any rules or regulations thereunder if such final determination (A) bars Mr. Taubman from employment in the securities industry or (B) renders Mr. Taubman unable to substantially perform his duties to PJT Partners Holdings; provided that, PJT Partners Holdings must provide a notice of termination to Mr. Taubman within 60 days of the occurrence of the event constituting “cause,” and, other than with respect to clause (ii) above, Mr. Taubman will have the opportunity to cure within 30 days of receiving such notice.

“good reason” means the occurrence of any of the following events without Mr. Taubman’s written consent: (i) a material adverse change in Mr. Taubman’s titles, positions, authority, duties or responsibilities; (ii) the assignment of any duties materially inconsistent with Mr. Taubman’s positions; (iii) a reduction of Mr. Taubman’s salary; (iv) the relocation of Mr. Taubman’s principal place of service to anywhere other than PJT Partners Holdings’ principal office; (v) a material breach by PJT Partners Holdings or its affiliates of the CEO Agreement or any other material agreement with PJT Partners Holdings or its affiliates; (vi) the failure of PJT Partners Holdings to nominate Mr. Taubman or Mr. Taubman’s failure to be elected to our Board of Directors (other than as a result of Mr. Taubman’s voluntary resignation) or Mr. Taubman’s removal as a member of the board by PJT Partners Holdings (other than for “cause”); (vii) the hiring or firing of any executive officer; or (viii) the failure by PJT Partners Holdings to obtain written assumption of the Partner Agreement by a purchaser or successor of PJT Partners Holdings; provided that, Mr. Taubman must provide a notice of termination to PJT Partners Holdings within 60 days of the occurrence of the event constituting “good reason,” and PJT Partners Holdings will have the opportunity to cure within 30 days of receiving such notice.

“Board Change Good Reason” means the occurrence of any of the following events without Mr. Taubman’s written consent: (i) a material adverse change in Mr. Taubman’s titles, positions, authority, duties or responsibilities; (ii) the assignment of any duties materially inconsistent with Mr. Taubman’s positions; (iii) a reduction of Mr. Taubman’s salary; (iv) the

| > | “cause” means the occurrence or existence of any of the following: |

(i)

| Mr. Taubman’s willful act of fraud, misappropriation, or embezzlement against PJT Partners Holdings that has a material adverse effect on the business of PJT Partners Holdings. |

(ii)

| Mr. Taubman’s conviction of a felony; or |

(iii)

| an un-appealable final determination by a court or regulatory body having authority with respect to securities laws that Mr. Taubman violated any applicable securities laws or any rules or regulations thereunder if such final determination: |

(A)

| bars Mr. Taubman from employment in the securities industry or |

(B)

| renders Mr. Taubman unable to substantially perform his duties to PJT Partners Holdings; provided that, PJT Partners Holdings must provide a notice of termination to Mr. Taubman within 60 days of the occurrence of the event constituting “cause,” and, other than with respect to clause (ii) above, Mr. Taubman will have the opportunity to cure within 30 days of receiving such notice. |

| > | “Good reason” means the occurrence of any of the following events without Mr. Taubman’s written consent: |

(i)

| a material adverse change in Mr. Taubman’s titles, positions, authority, duties or responsibilities. |

(ii)

| the assignment of any duties materially inconsistent with Mr. Taubman’s positions. |

(iii)

| a reduction of Mr. Taubman’s salary. |

(iv)

| the relocation of Mr. Taubman’s principal place of service to anywhere other than PJT Partners Holdings’ principal office; office. |

(v)

| a material breach by PJT Partners Holdings or its affiliates of the CEO Agreement or any other material agreement with PJT Partners Holdings or its affiliates, affiliates. |

(vi)

| the failure of PJT Partners Holdings to nominate Mr. Taubman or Mr. Taubman’s failure to be elected to ourthe Board of Directors (other than as a result of Mr. Taubman’s voluntary resignation) or Mr. Taubman’s removal as a member of the boardBoard by PJT Partners Holdings (other than for “cause”); |

(vii)

| the hiring or firing of any Executive Officer; or |

(viii)

| the failure by PJT Partners Holdings to obtain written assumption of the partner agreement by a purchaser or successor of PJT Partners Holdings; provided that, Mr. Taubman must provide a notice of termination to PJT Partners Holdings within 60 days of the occurrence of the event constituting “good reason,” and PJT Partners Holdings will have the opportunity to cure within 30 days of receiving such notice. |

TABLE OF CONTENTS

| > | “Board Change Good Reason” means the occurrence of any of the following events without Mr. Taubman’s written consent: |

(i)

| A material adverse change in Mr. Taubman’s titles, positions, authority, duties or responsibilities. |

(ii)

| The assignment of any duties materially inconsistent with Mr. Taubman’s positions. |

(iii)

| A reduction of Mr. Taubman’s salary. |

(iv)

| The relocation of Mr. Taubman’s principal place of service to anywhere other than PJT Partners Holdings’ principal office. |

(v)

| A breach by PJT Partners Holdings or its affiliates of the CEO Agreement or any other material agreement with PJT Partners Holdings or its affiliates. |

(vi)

| The failure of PJT Partners Holdings to nominate Mr. Taubman or Mr. Taubman’s failure to be elected to the Board (other than as a result of Mr. Taubman’s voluntary resignation) or Mr. Taubman’s removal as a member of the Board by PJT Partners Holdings (other than for “cause”); (vii) the failure by PJT Partners Holdings to obtain written assumption of the CEO Agreement by a purchaser or successor of PJT Partners Holdings, (viii) Holdings. |

(vii)

| PJT Partners Holdings or any of its affiliates effecting a material disposition, acquisition or other business combination; (ix) combination. |

(viii)

| PJT Partners Holdings or any of its affiliates entering into a new significant business line or discontinuing a significant existing business line, (x) line. |

(ix)

| the hiring or firing of any executive officer;Executive Officer; or (xi) |

(x)

| PJT Partners Holdings or any of its affiliates making any material compensation decisions with respect to partners or employees other than Mr. Taubman or PJT Partners Holdings or any of its affiliates failing to implement any material compensation decision made by Mr. Taubman with respect to partners or employees; provided that, Mr. Taubman must provide a notice of termination to PJT Partners Holdings within 120 days of the occurrence of the event constituting “Board Change Good Reason,” and PJT Partners Holdings will have the opportunity to cure within 10 days of receiving such notice. |

| > | “Board Change of Control” means a majority of the members of the Board ceasing to be “continuing directors” which means any member of the Board who: |

(i)

| was a member of such board immediately following the merger and spin-off transactions on October 1, 2015; or |

(ii)

| was nominated for election or elected or appointed to the board with the approval of a majority of the “continuing directors” who were members of such board at the time of such nomination, election or appointment. |

“Board Change of Control” means a majority of the members of our Board of Directors ceasing to be “continuing directors” which means any member of our Board of Directors who: (i) was a member of such board immediately following the merger andspin-off transactions on October 1, 2015; or (ii) was nominated for election or elected or appointed to the board with the approval of a majority of the “continuing directors” who were members of such board at the time of such nomination, election or appointment.

Partner Agreements withJi-Yeun Lee, Helen T. Meates and James W. Cuminale

David A. Travin

PJT Partners Holdings entered into partner agreements with each of Ms. Lee

and Ms. Meates,

effective October 1, 2015, and Mr.

Cuminale on OctoberTravin, effective January 1,

2015.2021. The agreements generally set forth the terms of service of each officer, including their respective compensation and benefits, as described in “Elements of

our ExecutiveOur Compensation Program.”

These officers are generally subject to covenants ofnon-competition andnon-solicitation of employees, consultants, clients and investors during their service to PJT Partners Holdings and for a period (the “Restriction Period”) ending on the later of (x) March 31, 2017 and (y) one year following the termination of service to PJT Partners Holdings in the case of thenon-competition restrictions, and two years following the termination of service to PJT Partners Holdings in the case of thenon-solicitation restrictions. If the executive officerExecutive Officer is terminated by PJT Partners Holdings without cause or the executive officerExecutive Officer resigns for good reason, the foregoing periods of time during which they will be subject to thenon-competition restrictions will be reduced to 120 days and 90 days, respectively. The officers are also subject to perpetual covenants of confidentiality andnon-disparagement.

TABLE OF CONTENTS

For purposes of the partner agreements with Ms. Lee, Ms. Meates and Mr.

Cuminale:“cause” means the occurrence or existence of any of the following: (i) (x) any material breach of the partner agreementTravin:

| > | “cause” means the occurrence or existence of any of the following: |

(i)

| (x) any material breach of the partner agreements, (y) material breach of any material rules or regulations of PJT Partners Holdings applicable that have been provided that has a material adverse effect on the business of PJT Partners Holdings, or (z) deliberate and repeated failure to perform substantially the Executive Officer’s material duties to PJT Partners Holdings; provided that, in the case of any of the foregoing clauses (x), (y) or (z), PJT Partners Holdings applicable that have been provided that has a material adverse effect on the business of PJT Partners Holdings, or (z) deliberate and repeated failure to perform substantially the executive officer’s material duties to PJT Partners Holdings; provided that, in the case of any of the foregoing clauses (x), (y) or (z), PJT Partners | Holdings has given the executive officerExecutive Officer written notice within fifteen days after PJT Partners Holdings becomes aware of such action and, to the extent such action is curable, the executive officerExecutive Officer fails to cure such breach, failure to perform or conduct or behavior within fifteen days after receipt by the executive officerExecutive Officer of such notice (or such longer period, not to exceed an additional fifteen days, as shall be reasonably required for such cure, provided that the executive officerExecutive Officer is diligently pursuing such cure); |

(ii)

| any act of fraud, misappropriation, embezzlement or similar conduct by the executive officerExecutive Officer against PJT Partners Holdings; or |

(iii)

| conviction (on the basis of a trial or by an accepted plea of guilty or nolo contendere) of a felony or crime of moral turpitude, or a determination by a court of competent jurisdiction, by a regulatory body or by a self-regulatory body having authority with respect to securities laws, rules or regulations, that the executive officerExecutive Officer individually has violated any securities laws or any rules or regulations thereunder, or any rules of any such self-regulatory body (including, without limitation, any licensing requirement), if such conviction or determination has a material adverse effect on on: |

(A)

| the executive officer’sExecutive Officer’s ability to function as a partner, taking into account the services required of the executive officerExecutive Officer and the nature of PJT Partners Holdings’ business, or |

(B)

| the business of PJT Partners Holdings. |

| > | “good reason” means the occurrence of any of the following events without the executive officer’s written consent: (i) a material adverse change in the executive officer’s title, authority, duties or responsibilities; (ii) the relocation of the executive officer’s principal place of service by more than 50 miles; (iii) a material breach by PJT Partners Holdings or its affiliates of the partner agreement or any other material agreement with PJT Partners Holdings or its affiliates; or (iv) the failure by PJT Partners Holdings to obtain written assumption of the partner agreement by a purchaser or successor of PJT Partners Holdings; provided that, the executive officer must provide a notice of termination to PJT Partners Holdings within 60 days of the occurrence of the event constituting Good Reason, and in the event the executive officer provides notice of “good reason,” PJT Partners Holdings will have the opportunity to cure such event constituting “good reason” within 30 days of receiving such notice.Merger andSpin-off Transaction Equity Grants

Founder Units. Pursuant to the partner agreements and the agreement governing the merger andspin-off transactions (the “Transaction Agreement”), certain of our partners, including our Named Executive Officers, acquired Partnership Units in PJT Partners Holdings (“Founder Units”). For purposes of this discussion, Founder Units also include “Founder LTIP Units” in PJT Partners Holdings, which are a series of LTIP Units that participate, from issuance, in all distributions by PJT Partners Holdings (other than liquidating distributions), ratably, on a per unit basis, with Partnership Units. Founder Units vest over a five year period, with 20% vesting on October 9, 2017 (the third anniversary of the signing of the Transaction Agreement), 30% vesting on October 9, 2018 (the fourth anniversary of the signing of the Transaction Agreement), and 50% vesting on October 9, 2019 (the fifth anniversary of the signing of the Transaction Agreement).

FounderEarn-Out Units. Certain of our partners, including our Named Executive Officers, acquired LTIP Units in PJT Partners Holdings (referred to as“Earn-Out Units”), which are subject to both time and performance vesting.Earn-Out Units satisfy the time-vesting requirement over a five year period, with 20% vested on October 9, 2017 (the third anniversary of the signing of the Transaction Agreement), 30% vesting on October 9, 2018 (the fourth anniversary of the signing of the Transaction Agreement), and 50% vesting on October 9, 2019 (the fifth anniversary of the signing of the Transaction Agreement). The performance vesting requirement will be satisfied upon the shares

of the company’s Class A common stock achieving certain volume-weighted average share price targets over any consecutive30-day trading period, as follows:

20% of theEarn-Out Units will be earned upon achieving a volume-weighted average trading price of Class A common stock of $48 per share;

20% of theEarn-Out Units will be earned upon achieving a volume-weighted average trading price of Class A common stock of $55 per share;

20% of theEarn-Out Units will be earned upon achieving a volume-weighted average trading price of Class A common stock of $63 per share;

20% of theEarn-Out Units will be earned upon achieving a volume-weighted average trading price of Class A common stock of $71 per share; and

20% of theEarn-Out Units will be earned upon achieving a volume-weighted average trading price of Class A common stock of $79 per share.

The performance vesting requirements must be met prior to October 1, 2021, the sixth anniversary of the closing of the merger andspin-off transactions, and anyEarn-Out Units not meeting the designated requirements prior to such date will be forfeited. No portion of theEarn-Out Units will become vested until both the time-vesting and performance-vesting conditions have been satisfied.

The Founder Units andEarn-Out Units are subject to the terms of the partnership agreement of PJT Partners Holdings, the Omnibus Incentive Plan and the applicable award agreements. The units are also subject to certain treatment in connection with a termination of service or a change in control. See “Potential Payments upon Termination of Employment or Change in Control—Merger andSpin-off Transaction Grants” below.

Outstanding Equity Awards at 2017 FiscalYear-End

The following table sets forth the outstanding equity awards held by our Named Executive Officers as of December 29, 2017.

| | | | | | | | | Name | | Stock Awards | | | Number of Shares

or Units of

Stock That Have

Not Vested

(#) | | Market Value of

Shares or Units

of Stock That

Have Not

Vested(5)

($) | | Equity Incentive

Plan Awards:

Number of

Unearned

Shares, Units or

Other Rights That

Have Not

Vested(6)

(#) | | Equity Incentive

Plan Awards: Market or

Payout Value of Unearned

Shares, Units or Other Rights

That Have Not Vested(5)

($) | Paul J. Taubman | | 2,200,000(1) | | 100,320,000 | | 3,050,000 | | 139,080,000 | Ji-Yeun Lee | | 383,251(2) | | 17,476,246 | | 475,000 | | 21,660,000 | Helen T. Meates | | 89,050(3) | | 4,060,659 | | 50,000 | | 2,280,000 | James W. Cuminale | | 88,458(4) | | 4,033,662 | | 75,000 | | 3,420,000 |

| (1) | This amount consists of 2,200,000 Founder Units representing the unvested tranches of the 2,750,000 units acquired by Mr. Taubman upon closingfollowing events without the Executive Officer’s written consent:

|

(i)

| a material adverse change in the Executive Officer’s title, authority, duties or responsibilities; |

(ii)

| the relocation of the merger andspin-off transactions on October 1, 2015,Executive Officer’s principal place of which 825,000 vest on October 9, 2018 and 1,375,000 vest on October 9, 2019.service by more than 50 miles; |

(iii)

| (2) | This amount consists of (i) 364,000 Founder Units representing the unvested tranchesa material breach by PJT Partners Holdings or its affiliates of the 455,000 units acquiredpartner agreement or any other material agreement with PJT Partners Holdings or its affiliates; or

|

(iv)

| the failure by Ms. Lee upon closingPJT Partners Holdings to obtain written assumption of the merger andspin-off transactions on October 1, 2015,partner agreement by a purchaser or successor of which 136,500 vest on October 9, 2018 and 227,500 vest on October 9, 2019, (ii) 19,152 restricted stock unitsPJT Partners Holdings; provided that, vest ratably on March 1, 2018, 2019 and 2020, and (iii) 99 unvested dividend equivalent restricted stock units. |

| (3) | This amount consiststhe Executive Officer must provide a notice of (i) 80,000 Founder Units representing the unvested tranchestermination to PJT Partners Holdings within 60 days of the 100,000 units acquired by Ms. Meates upon closingoccurrence of the mergerevent constituting Good Reason, andspin-off transactions on October 1, 2015, in the event the Executive Officer provides notice of which 30,000 vest on October 9, 2018 and 50,000 vest on October 9, 2019, (ii) 9,003 restricted stock units that vest ratably on March 1, 2018, 2019 and 2020, and (iii) 47 unvested dividend equivalent restricted stock units.

“good reason,” PJT Partners Holdings will have the opportunity to cure such event constituting “good reason” within 30 days of receiving such notice. |

| (4) | This amount consists of (i) 80,000 Founder Units representing the unvested tranches of the 100,000 units acquired by Mr. Cuminale upon closing of the merger andspin-off transactions on October 1, 2015, of which 30,000 vest on October 9, 2018 and 50,000 vest on October 9, 2019, (ii) 8,414 restricted stock units that vest ratably on March 1, 2018, 2019 and 2020, and (iii) 44 unvested dividend equivalent restricted stock units

|

| (5) | Based on the closing price of our Class A common stock of $45.60 on December 29, 2017.

|

| (6) | Earn-Out Units acquired upon closing of the merger andspin-off transactions on October 1, 2015 (including 1,474,553 units for Mr. Taubman that were received in exchange for the contribution of his interest in PJT Capital LP, our predecessor firm) that are subject to both time and performance vesting.Earn-Out Units satisfy the time-vesting requirement over a five year period, with 20% vested on October 9, 2017, 30% vesting on October 9, 2018, and 50% vesting on October 9, 2019. The performance vesting requirement will be satisfied upon the shares of Class A common stock achieving the applicable share price targets described above under “Narrative Disclosure Relating to the Summary Compensation Table and the Grants of Plan-Based Awards Table—Merger andSpin-off Transaction Equity Grants—FounderEarn-Out Units.” The number ofEarn-Out Units reported reflects the total number of units granted even though the performance period will not end until October 1, 2021 and vesting is contingent on meeting certain volume-weighted average share price targets. Therefore, there is no assurance that any portion of these units will be earned. See “Partner Agreements—Merger andSpin-Off Transaction Equity Grants” for a description of theEarn-Out Units.

|

2017 Option Exercises and Stock Vested

The following table sets forth certain information regarding equity awards that vested in 2017 for our Named Executive Officers.

| | | | | | | | | | | | Stock or Unit Awards | | Name | �� | Number of Shares or Units

Acquired on Vesting(1)

(#) | | | Value Realized on Vesting(2)

($) | | Paul J. Taubman | | | 550,000 | | | | 20,234,500 | | Ji-Yeun Lee | | | 91,000 | | | | 3,347,890 | | Helen T. Meates | | | 20,000 | | | | 735,800 | | James W. Cuminale | | | 20,000 | | | | 735,800 | |

| (1) | Represents the aggregate number of Founder Units that vested in 2017. These Founder Units were issued pursuant to the Omnibus Incentive Plan.

|

| (2) | The value realized on vesting of the Founder Units is the product of (a) the closing price on the New York Stock Exchange of a share of our Class A common stock on the vesting date (or, if the vesting date was not a trading day, the immediately preceding trading day), multiplied by (b) the number of Founder Units vesting.

|

Potential Payments upon Termination of Employment or Change in Control Other than with respect to the potential continued or accelerated vesting of outstanding equity awards that each of our Named Executive Officers may be entitled to in connection with certain terminations of employment or a change in control, our Named Executive Officers are not entitled to any additional payments or benefits following a change in control or upon termination of employment, and are only entitled to payments and benefits that are available generally on a non-discriminatory basis to all salaried employees, such as continuation of health care benefits through the end of the month of the termination of employment. Merger andSpin-off Transaction Grants of Founder Units andEarn-Out Units

Paul J. Taubman

If Mr. Taubman’s service to PJT Partners Holdings terminates for any reason other than Mr. Taubman’s resignation without good reason or by PJT Partners Holdings for cause, then: (i) all unvested Founder Units will remain outstanding and continue to be eligible to vest during the Restriction Period (as defined above) and will vest in full upon the expiration of the Restriction Period (or, if earlier, the date of Mr. Taubman’s death); and (ii) the unvestedEarn-Out Units will remain outstanding and become vested upon the satisfaction of the applicable stock price performance conditions and continue to be eligible to time vest on their regularly scheduled vesting dates during the Restriction Period, with full time-vesting at the end of the Restriction Period (or, if earlier, the date of Mr. Taubman’s death). If Mr. Taubman’s service is terminated because of death (other than within 24 months following a Board Change of Control), the time-vesting conditions for theEarn-Out Units will be deemed satisfied and all unvestedEarn-Out Units will remain outstanding and become fully vested upon the satisfaction of the applicable stock price performance conditions.

Notwithstanding the foregoing, if Mr. Taubman’s service to PJT Partners Holdings is terminated for any reason other than his resignation without Board Change Good Reason (as defined above), or termination by PJT Partners Holdings for cause, in each case within 24 months following a Board Change of Control (as defined above), then all of Mr. Taubman’s unvested Founder Units andEarn-Out Units will fully vest upon such termination, without regard to any applicable service or performance vesting conditions. In the event of any other termination of Mr. Taubman’s service or his uncured breach of thenon-competition ornon-solicitation covenants contained in his partner agreement, his unvested Founder Units andEarn-Out Units will be forfeited automatically.

Upon a change in control of PJT Partners, then (i) all unvested Founder Units will vest in full immediately, and (ii) the time-vesting conditions for theEarn-Out Units will be deemed satisfied, but the performance-vesting conditions will be satisfied only if the applicable share price targets are achieved in connection with such change in control.

For these purposes, “cause” and “good reason” have the same meanings ascribed to such terms in Mr. Taubman’s partner agreement. See “Narrative Disclosure Relating to the Summary Compensation Table and the Grants of Plan-Based Awards Table—Partner Agreements—Partner Agreement with Paul J. Taubman” above.

Ji-Yeun Lee, Helen T. Meates and James W. Cuminale

If Ms. Lee’s, Ms. Meates’s or Mr. Cuminale’s service terminates for any reason other than such officer’s resignation without good reason or by PJT Partners Holdings for cause, then (i) all of such officer’s unvested Founder Units will remain outstanding and continue to be eligible to vest on their regularly scheduled vesting dates during the Restriction Period (as defined above) and will vest in full upon the expiration of the Restriction Period (or, if earlier, the date of such officer’s death), and

(ii) the unvestedEarn-Out Units will become vested to the extent the applicable stock price performance conditions are met on or prior to the date of termination of service and, unless otherwise determined by Mr. Taubman, all remaining unvestedEarn-Out Units will be forfeited. In the event of any other termination of the officer’s service or uncured breach of thenon-competition ornon-solicitation covenants (described below), such officer’s unvested Founder Units andEarn-Out Units will be forfeited automatically.

Upon a change in control of PJT Partners, then (i) all unvested Founder Units vest in full immediately, and (ii) the time-vesting conditions for theEarn-Out Units will be deemed satisfied, but the performance-vesting conditions will be satisfied only if the applicable share price targets are achieved in connection with such change in control.

For these purposes, “cause” and “good reason” have the same meanings ascribed to such terms in the partner agreements with each of Ms. Lee, Ms. Meates and Mr. Cuminale. See “Narrative Disclosure Relating to the Summary Compensation Table and the Grants of Plan-Based Awards Table—Partner Agreements—Partner Agreements withJi-Yeun Lee, Helen T. Meates and James W. Cuminale”above.

Restricted Stock Unit Awards If the participant’s employment is terminated for cause, the participant’s undelivered restricted stock unitsRSUs (vested and unvested) will be immediately forfeited, and if the participant resigns, the participant’s unvested restricted stock unitsRSUs will be immediately forfeited. Upon a change in control or termination of the participant’s services because of death, disability or without cause by the company, the shares underlying any outstanding RSUs (vested and unvested) will become immediately deliverable. In connection with a

TABLE OF CONTENTS qualifying retirement, RSUs will continue to vest and be delivered over the applicable vesting period, subject to forfeiture if the participant violates any applicable provision of his or her employment or partner agreement or engages in any competitive activity. If the participant’s employment is terminated for cause, the participant’s undelivered LTIP Units (vested and unvested) will be immediately forfeited, and if the participant resigns, the participant’s unvested LTIP Units will be immediately forfeited. Upon a change in control or termination of the participant’s services because of death, disability or without cause by the company, the shares underlying any outstanding restricted stock unitsLTIP Units (vested and unvested) will become immediately deliverable. In connection with a qualifying retirement, restricted stock unitsLTIP Units will continue to vest and be delivered over the applicable vesting period, subject to forfeiture if the participant violates any applicable provision of his or her employment or partner agreement or engages in any competitive activity. If the participant’s employment is terminated for cause or the participant resigns, the participant’s unvested Performance LTIPs will be immediately forfeited. Upon a change in control or termination of the participant’s services because of death, disability or without cause by the company, the shares underlying any outstanding Performance LTIPs will be deemed to have fully satisfied the service condition of the award and any units that have met the performance condition will become vested as of the termination date. In connection with a qualifying retirement, Performance LTIPs will continue to vest over the applicable vesting period, provided the performance conditions are met, but are subject to forfeiture if the participant violates any applicable provision of his or her employment or partner agreement or engages in any competitive activity. Mr. Taubman’s Performance LTIPs do not have a retirement provision. The following table quantifies the value of our Named Executive Officers’ outstanding equity awards that would accelerate and vest upon certain terminations of employment or a change in control. All calculations in this table are based on an assumed termination or change in control date of December 29, 2017. | | | | | | | | | | | | | Name | | Accelerated

Vesting of Equity

Awards: Founder

Units(1)

($) | | | Accelerated Vesting

of Equity Awards:

FounderEarn-Out

Units(1)

($) | | | Accelerated Vesting of

Equity Awards:

Restricted Stock

Units(1)

($) | | Paul J. Taubman | | | | | | | | | | | | | Termination by us with “cause” or resignation by employee without “good reason” | | | — | | | | — | | | | N/A | | Termination by us without “cause” or resignation by employee for “good reason”not within 24 months following a “Board Change of Control” | | | —(2) | | | | —(3) | | | | N/A | | Termination by us without “cause” or resignation by employee for “Board Change Good Reason” within 24 months following a “Board Change of Control” | | | 100,320,000 | | | | 139,080,000 | | | | N/A | | Disability | | | N/A | | | | N/A | | | | N/A | | Deathnot within 24 months following “Board Change of Control” | | | 100,320,000 | | | | —(4) | | | | N/A | | Death within 24 months following “Board Change of Control” | | | 100,320,000 | | | | 139,080,000 | | | | N/A | | Change in control | | | 100,320,000 | | | | —(5) | | | | N/A | | | | | | Ji-Yeun Lee | | | | | | | | | | | | | Termination by us with “cause” or resignation by employee without “good reason” | | | — | | | | — | | | | — | | Termination by us without “cause” | | | —(2) | | | | —(6) | | | | 877,846 | | Resignation by employee for “good reason” | | | —(2) | | | | —(6) | | | | N/A | | Disability | | | N/A | | | | N/A | | | | 877,846 | | Death | | | 16,589,400 | | | | —(6) | | | | 877,846 | | Change in control | | | 16,589,400 | | | | —(5) | | | | 877,846 | | | | | | Helen T. Meates | | | | | | | | | | | | | Termination by us with “cause” or resignation by employee without “good reason” | | | — | | | | — | | | | — | | Termination by us without “cause” | | | —(2) | | | | —(6) | | | | 412,659 | | Resignation by employee for “good reason” | | | —(2) | | | | —(6) | | | | N/A | | Disability | | | N/A | | | | N/A | | | | 412,659 | | Death | | | 3,648,000 | | | | —(6) | | | | 412,659 | | Change in control | | | 3,648,000 | | | | —(5) | | | | 412,659 | | | | | | James W. Cuminale | | | | | | | | | | | | | Termination by us with “cause” or resignation by employee without “good reason” | | | — | | | | — | | | | — | | Termination by us without “cause” | | | —(2) | | | | —(6) | | | | 385,662 | | Resignation by employee for “good reason” | | | —(2) | | | | —(6) | | | | N/A | | Disability | | | N/A | | | | N/A | | | | 385,662 | | Death | | | 3,648,000 | | | | —(6) | | | | 385,662 | | Change in control | | | 3,648,000 | | | | —(5) | | | | 385,662 | |

| Name | (1) | | Accelerated Vesting of Equity Awards(1)(2) | | Paul J. Taubman | | | | | Termination by Us with “Cause” | | | — | | Termination by Us without “Cause” | | | $40,748,000 | | Disability | | | $40,748,000 | | Death | | | $40,748,000 | | Change in Control | | | $40,748,000 | | Ji-Yeun Lee | | | | | Termination by Us with “Cause” | | | — | | Termination by Us without “Cause” | | | $5,874,537 | | Disability | | | $5,874,537 | | Death | | | $5,874,537 | | Change in Control | | | $5,874,537 | | Helen T. Meates | | | | | Termination by Us with “Cause” | | | — | | Termination by Us without “Cause” | | | $4,788,815 | | Disability | | | $4,788,815 | | Death | | | $4,788,815 | | Change in Control | | | $4,788,815 | | David A. Travin | | | | | Termination by Us with “Cause” | | | — | | Termination by Us without “Cause” | | | $2,087,819 | | Disability | | | $2,087,819 | | Death | | | $2,087,819 | | Change in Control | | | $2,087,819 |

(1)

| The value of accelerated equity awards, for purposes of this table, was determined by multiplying the applicable number of equity awards (including associated restricted stock unitRSU dividend equivalents) that would vest upon termination or change in control by $45.60,$101.87, the closing price of our Class A common stock on December 29, 2017.31, 2023, assuming the same value as the change in control price. Values reflect Performance LTIPs that have achieved the performance vesting requirements but are yet to achieve service requirements as of December 31, 2023. |

(2)

| (2)Mr. Taubman’s Performance LTIPs have no retirement provision. |

TABLE OF CONTENTS | All unvested Founder Units will remain

| | |

Presented below is the ratio of annual total compensation of Mr. Taubman, our CEO, to the median annual total compensation for all our employees (other than our CEO) as of December 31, 2023 (the “CEO Pay Ratio”). We believe the pay ratio included below is a reasonable estimate determined under relevant SEC rules. However, due to the flexibility afforded by Item 402(u) of Regulation S-K in calculating the CEO Pay Ratio, our CEO Pay Ratio may not be comparable to the CEO pay ratios presented by other companies. For 2023, the annual total compensation of our median employee, the annual total compensation of our CEO, pursuant to the methodology described below and in accordance with the requirements for determining total compensation in the Summary Compensation Table, and the resulting pay ratio are shown in the table below: | | | 2023 Annual Total Compensation | | CEO | | | $1,029,620 | | Median Employee | | | $437,000 | | CEO Pay Ratio | | | 2:1 |

If the 2023 annual compensation for Mr. Taubman was calculated based on the methodology applied in the table under “Compensation of Our Executive Officers — Elements of Our Compensation Program — Alternative Presentation of Annual Compensation,” which is reflective of compensation related to the 2023 performance year, the total annual compensation for Mr. Taubman for 2023 would be $1,000,000, resulting in a ratio of the annual total compensation of Mr. Taubman to the annual total compensation of our median employee of approximately 2 to 1. We identified our median employee using our partner and employee population, excluding Mr. Taubman, as of December 31, 2021. To identify our median employee, we used: (2)

| cash bonus awarded in respect of such year’s performance, and |

(3)

| long-term incentives awarded in respect of such year’s performance. |

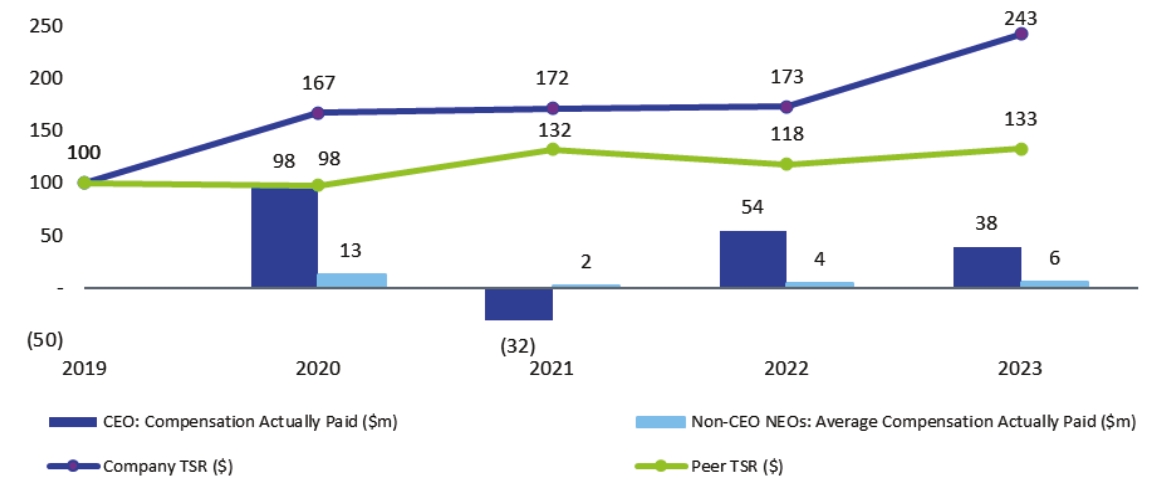

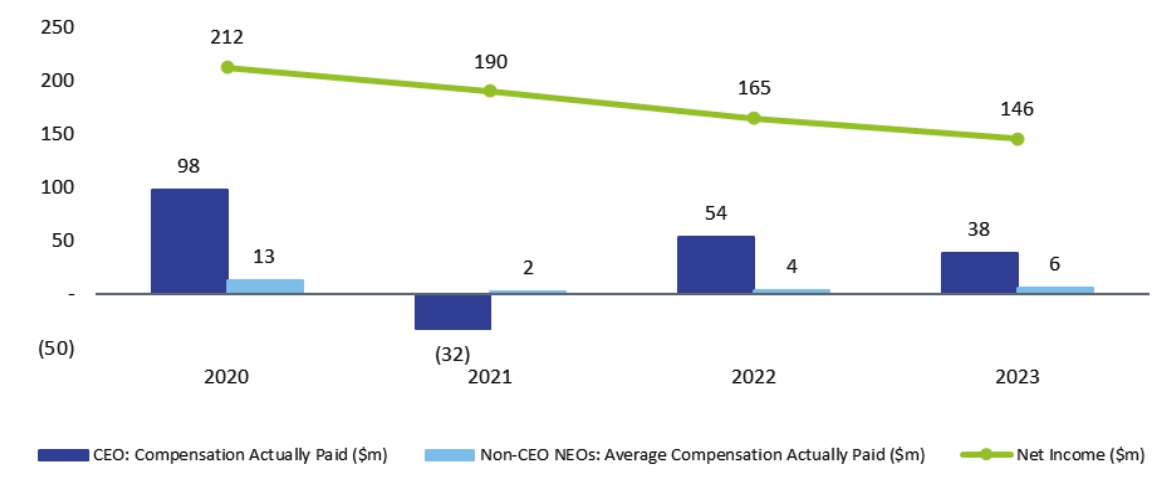

We believe this consistently applied compensation measure reasonably reflects annual compensation across our employee base. This methodology was also applied to compensation reflected for our Named Executive Officers in the table under “Compensation of Our Executive Officers — Elements of Our Compensation Program — Alternative Presentation of Annual Compensation” and represents compensation in the manner considered by our Compensation Committee for determining annual compensation. TABLE OF CONTENTS Pay versus Performance The Compensation Discussion and Analysis section of this Proxy Statement sets forth the financial and other factors considered by the Compensation Committee when reviewing and setting the compensation of our CEO and other Named Executive Officers (“non-CEO NEOs”) for the 2023 performance year. Our executive compensation program considers company-wide financial measures to ensure alignment with shareholders, in addition to goals targeted to each of the Named Executive Officers. We seek to ensure that each Named Executive Officer has goals that are tied to tangible measures of business success as well as those that are focused on leadership and talent development. Rewards for our Executive Officers are structured to ensure a focus on the long-term success of the company. This is typically achieved by granting a significant portion of annual incentives in the form of restricted stock awards that vest over four years. As required by Item 402(v) (the “Rule”) of Regulation S-K, the following sets forth information regarding compensation of our CEO and our non-CEO NEOs. In accordance with the Rule, the table below and the discussion that follows includes an amount referred to as “compensation actually paid” as defined in Item 402(v)(2)(iii). The calculation of this amount includes, among other things, the revaluation of unvested and outstanding equity awards. In accordance with the Rule, the revaluation of stock and option awards includes, as applicable: | > | the year-end fair value of the awards granted in the covered fiscal year (e.g., 2023) that are outstanding and continue to be eligible to vest on their regularly scheduled vesting dates during the Restriction Period (as defined above) and will vest in full upon the expirationunvested as of the Restriction Period (or, if earlier, the date of the executive’s death). |

| (3) | All unvestedEarn-Out Units will remain outstanding and become vested upon the satisfaction of the applicable stock price performance conditions and continue to be eligible to time vest on their regularly scheduled vesting dates during the Restriction Period, with full time-vesting at the end of the Restriction Period (or, if earlier, covered fiscal year;

|

| > | the change in fair value from the end of the prior fiscal year (e.g., 2023) to the end of the covered fiscal year with respect to any awards granted in prior years that are outstanding and unvested as of the end of the covered fiscal year; |

| > | the fair value, as of the vesting date, of any awards that were granted and vested in the executive’s death).same covered year; and |

| > | (4) | The time-vesting conditions for theEarn-Out Units will be deemed satisfied and all unvestedEarn-Out Units will remain outstanding and become vested upon the satisfactionchange in fair value from the end of the prior fiscal year to the vesting date or forfeiture date with respect to any awards granted in prior years that vested or failed to vest, as applicable, stock price performance conditions.

in the covered fiscal year. Stock awards include the dollar amount of accrued dividend equivalents, if applicable. |

Importantly, as of the valuation dates in the table, none of the amounts included in “compensation actually paid” for our CEO and non-CEO NEOs relating to performance share awards have been paid to our CEO or non-CEO NEOs. The amounts actually received will depend upon the company’s stock price at point of vesting, including in the case of performance shares, whether the requisite performance hurdles and service requirements are met. Compensation actually paid to our CEO includes valuations in respect of awards granted at the spin-off, with such units earned as a result of the company achieving certain share price thresholds. Specifically, 98% of the 2020 compensation actually paid value relates to the vesting of two tranches of Mr. Taubman’s performance Earn-Out award for which share price hurdles were achieved during the year, in aggregate equating to stock price appreciation of more than 300% from inception. The final tranche of Mr. Taubman's Earn-Out award failed to meet the share price hurdle within the required time frame, which would have required share price appreciation of 376% since inception. Accordingly, 2021 compensation actually paid includes value attributed to the forfeiture of this final tranche. For 2022, the values represent the Performance LTIP units granted to Mr. Taubman on February 10, 2022 that generally vest over a five-year period contingent on the achievement of significant performance hurdles and Mr. Taubman’s continued employment with the company for five years from grant. The company does not currently anticipate paying Mr. Taubman any further equity incentive compensation through the end of 2026. These Performance LTIP units are intended to reward performance on a multi-year basis and in a manner that is fully aligned with shareholders. For 2023, the values reflect a portion of Performance LTIP units that vested on the basis of achieving the first performance hurdle of a 20-day VWAP in excess of $100 and having satisfied the first service condition of the award. TABLE OF CONTENTS Pay versus Performance Table Year | | | Summary

Compensation

Table Total

for PEO(1)(2) | | | Compensation

Actually Paid

to PEO(1)(3)(6) | | | Average

Summary

Compensation

Table Total

for Non-PEO

NEOs(4) | | | Average

Compensation

Actually Paid

to Non-PEO

NEOs(5)(6) | | | Value of Initial Fixed $100

Investment Based On(7): | | | | | | | | | Total

Shareholders

Returns | | | Peer Group

Total

Shareholders

Returns(8) | | | Net

Income

($mm) | | | Share

Price(9) | | 2023 | | | $1,029,620 | | | $38,447,620 | | | $3,520,153 | | | $5,848,229 | | | $243 | | | $133 | | | $146 | | | $101.87 | | 2022 | | | $40,116,595 | | | $53,986,595 | | | $3,598,663 | | | $3,982,497 | | | $173 | | | $118 | | | $165 | | | $73.69 | | 2021 | | | $1,015,000 | | | $(31,601,946) | | | $4,146,658 | | | $2,251,711 | | | $172 | | | $132 | | | $190 | | | $74.09 | | 2020 | | | $1,015,000 | | | $98,109,055 | | | $5,195,368 | | | $12,727,694 | | | $167 | | | $98 | | | $212 | | | $75.25 |

(1)

| Our CEO, Mr. Taubman, is our Principal Executive Officer (PEO). |

(2)

| The amounts included in controlthis column are the time-vesting conditionstotal compensation amounts disclosed in the Summary Compensation Table for theEarn-Out Units will be deemed satisfied, but the performance-vesting conditions will be satisfied only if the applicable share price targets are achieved in connection with such change in control. Amount reported assumes that the price paid in connection with a change in control would have been $45.60, the closing price of our Class A Common stock on December 29, 2017, and therefore noneeach of the performance vesting price targets would have been achieved and allyears included. |

(3)

| Compensation actually paid was calculated in accordance with the rules outlined under Item 402(v)(2)(iii) of the executive’s unvestedEarn-Out Units would have been forfeited. |

| (6) | All unvestedEarn-Out Units will become vestedRegulation S-K. The following table outlines adjustments made to the extent the applicable stock price performance conditions are met on or prior to the date of termination of service and, unless otherwise determined by Mr. Taubman, all remaining unvestedEarn-Out Units will be forfeited. On December 29, 2017, none of the applicable stock price performance conditions had been met and the amounts reported assume thatfor Mr. Taubman wouldin the Summary Compensation Table. Importantly, the amounts do not have exercised his discretionreflect the actual amount of compensation earned by, or paid to, vest allMr. Taubman during the unvestedEarn-Out Units. As a result, allapplicable year.

|

| Year | | | Grant Date

Fair Value of

Equity Awards

Granted in the

Year(a) | | | Change in

Pension

Value

Deduction(b) | | | Pension

Service Cost

Addition(b) | | | Prior

Pension

Service

Cost

Addition(b) | | | Stock and

Option Awards

Adjustment(c) | | | Total

Adjustments | | 2023 | | | — | | | — | | | — | | | — | | | $37,418,000 | | | $37,418,000 | | 2022 | | | $(39,100,000) | | | — | | | — | | | — | | | $52,970,000 | | | $13,870,000 | | 2021 | | | — | | | — | | | — | | | — | | | $(32,616,946) | | | $(32,616,946) | | 2020 | | | — | | | — | | | — | | | — | | | $97,094,055 | | | $97,094,055 |

(a)

| The reported value of equity awards represents the grant date fair value of equity awards as reported in the “Stock Awards” column of the executive’s unvestedEarn-Out Units wouldSummary Compensation Table for each applicable year. These values are subtracted for the purposes of the Pay versus Performance calculation per the rules outlined under the Rule. |

(b)

| Our CEO does not participate in any company pension plans, therefore compensation adjustment represented is zero. |

(c)

| For each covered year, the amounts added or deducted in calculated stock and option award adjustments include: |

| Year | | | Year End Fair

Value of

Equity

Awards

Granted

during the

Year | | | Year over Year

Change in Fair

Value of

Outstanding

and

Unvested

Equity

Awards | | | Fair Value

as of

Vesting

Date of

Equity

Awards

Granted and

Year | | | Change in

Fair Value of

Equity Awards

Granted in

Prior

Years that

Vested in

the Year | | | Fair Value at

the End of the

Prior Year of

Equity Awards

that Failed to

Meet Vesting

Conditions in

the Year | | | Value of

Dividends or

Other Earnings

Paid on Stock or

Option Awards

not Otherwise

Reflected in Fair

Value or Total

Compensation | | | Total Stock

and Option

Awards

Adjustment | | 2023 | | | — | | | $32,409,000 | | | — | | | $5,009,000 | | | — | | | — | | | $37,418,000 | | 2022 | | | $52,970,000 | | | — | | | — | | | — | | | — | | | — | | | $52,970,000 | | 2021 | | | — | | | — | | | — | | | $72,954 | | | $(32,689,900) | | | — | | | $(32,616,946) | | 2020 | | | — | | | $28,841,015 | | | — | | | $68,253,040 | | | — | | | — | | | $97,094,055 |

(4)

| The amounts included in this column represent the average of the total compensation amounts disclosed in the Summary Compensation Table to Ms. Lee, Ms. Meates and Mr. Travin for fiscal years 2023, 2022 and 2021. |

(5)

| Average compensation actually paid for our non-CEO NEOs was calculated in accordance with the rules outlined under Item 402(v)(2)(iii) of Regulation S-K. The following adjustments were made to the amounts reported in the Summary Compensation Table for our non-CEO NEOs. Importantly, the amounts do not reflect the actual average amount of compensation earned by, or paid to, our other Named Executive Officers as a group during the applicable year. |

TABLE OF CONTENTS | Year | | | Grant Date

Fair Value of

Equity Awards

Granted In the

Year(a) | | | Change in

Pension

Value

Deduction(b) | | | Pension

Service Cost

Addition(b) | | | Prior

Pension

Service

Cost

Addition(b) | | | Stock and

Option

Awards

Adjustment(c) | | | Total

Adjustments | | 2023 | | | $(1,209,966) | | | — | | | — | | | — | | | $3,538,042 | | | $2,328,076 | | 2022 | | | $(1,404,576) | | | — | | | — | | | — | | | $1,788,410 | | | $383,834 | | 2021 | | | $(1,044,991) | | | — | | | — | | | — | | | $(849,956) | | | $(1,894,947) | | 2020 | | | $(1,225,368) | | | — | | | — | | | — | | | $8,757,694 | | | $7,532,326 |

(a)

| The reported value of equity awards represents the grant date fair value of equity awards as reported in the “Stock Awards” column of the Summary Compensation Table for each applicable year. These values are subtracted for the purposes of the Pay versus Performance calculation per the rules outlined under the Rule. |

(b)

| Our non-CEO NEOs do not participate in any company pension plans, therefore compensation adjustment represented is zero. |

(c)

| For each covered year, the amounts added or deducted in calculated stock and option award adjustments include: |

| Year | | | Year End Fair

Value of

Equity

Awards

Granted

during the

Year | | | Year over Year

Change in Fair

Value of

Outstanding

and

Unvested

Equity

Awards | | | Fair Value

as of

Vesting

Date of

Equity

Awards

Granted and

Vested In

the Year | | | Change in

Fair Value of

Equity Awards

Granted in

Prior Years

that Vested

in the Year | | | Fair Value at

the End of the

Prior Year of

Equity Awards

that Failed to

Meet Vesting

Conditions in

the Year | | | Value of

Dividends or

other Earnings

Paid on Stock or

Option Awards

not Otherwise

Reflected in Fair

Value or Total

Compensation | | | Total Stock

and Option

Awards

Adjustment | | 2023 | | | $1,600,042 | | | $1,501,018 | | | — | | | $436,982 | | | — | | | — | | | $3,538,042 | | 2022 | | | $1,902,824 | | | $14,469 | | | — | | | $(128,883) | | | — | | | — | | | $1,788,410 | | 2021 | | | $1,096,990 | | | $34,214 | | | — | | | $(105,511) | | | $(1,875,650) | | | — | | | $(849,956) | | 2020 | | | $1,744,377 | | | $2,555,994 | | | — | | | $4,457,323 | | | — | | | — | | | $8,757,694 |

(6)

| When calculating amounts of “compensation actually paid” for purposes of this table: |

(i)

| The fair value of RSU and LTIP unit awards was estimated as of the relevant valuation date in accordance with ASC Topic 718. |

(ii)

| The fair value of performance awards was estimated at each valuation date using a Monte Carlo simulation and the key assumptions as described in Note 10 to our financial statements for the fiscal year ended December 31, 2023 included in the company’s Annual Report on Form 10-K filed with the SEC. The assumptions used were not materially changed from those described in Note 10 but were updated at each valuation date to reflect the then-current value of each variable. |

(7)

| Total shareholder return, including reinvestment of dividends, as calculated based on a fixed investment of one hundred dollars measured from the market close on December 31, 2020 (the last trading day of 2020) through and including the end of the fiscal year for each year reported in the table as required by the Rule. |

(8)

| Total shareholder return for S&P 500 Financials Index. |

(9)